GOODYEAR REPORTS RECORD FOURTH QUARTER, FULL-YEAR 2015 RESULTS

10 Feb 16

Goodyear today reported results for the fourth quarter and full year of 2015.

“I’m extremely pleased with our outstanding results as we delivered 18 percent growth in full-year segment operating income, exceeding $2 billion for the first time in our 117-year history,” said Chairman and CEO Rich Kramer. “Our success has enabled us to execute on all facets of our capital allocation plan, delivering long-term shareholder value.”

“Fourth quarter earnings grew 16 percent in our North America business and 20 percent in Asia Pacific, both records. Earnings in Europe, Middle East and Africa recovered in the quarter despite a challenging environment,” he added.

“Our record results reflect strong demand for our high-value-added Goodyear-brand tires and our focus on capturing the value of these products in the marketplace,” Kramer continued.

“While economic uncertainty in the global environment will persist in 2016, we remain committed to our target of 10 to 15 percent growth in segment operating income from our ongoing operations,” Kramer said. Following the deconsolidation of its Venezuelan subsidiary, the company is targeting record segment operating income of $2.1 billion to $2.2 billion for 2016.

Goodyear’s fourth quarter 2015 sales were $4.1 billion, compared to $4.4 billion a year ago. Sales were impacted by $339 million in unfavorable foreign currency translation.

Tire unit volumes totaled 42.1 million, up 7 percent from 2014, due in part to the acquisition of Nippon Goodyear Ltd. (NGY) in Japan. Replacement tire shipments were up 9 percent. Original equipment unit volume was up 2 percent.

The company reported segment operating income of $476 million in the fourth quarter of 2015, up 33 percent from a year ago. The increase was driven by favorable price/mix net of raw materials and higher volume, partially offset by cost inflation and unfavorable foreign currency translation.

On a GAAP basis, Goodyear’s fourth quarter 2015 net loss available to common shareholders was $380 million ($1.42 per share). Excluding certain significant items, most notably the deconsolidation of the Venezuelan subsidiary, adjusted net income was $257 million (93 cents per share).

Goodyear’s full-year effective tax rate was better than the company’s guidance, driven by a lower-than-expected rate in the fourth quarter. Fourth quarter 2015 adjusted net income was impacted by $28 million of U.S. tax expense following the release of the company’s $2.2 billion U.S. tax valuation allowance in 2014. This incremental tax expense was more than offset by the recognition of $55 million (20 cents per share) of U.S. foreign tax credits and research and development tax credits as a result of legislative actions in December 2015. In total, adjusted net income was impacted by a net U.S. tax benefit of $27 million (10 cents per share) in the fourth quarter. Due to tax credits and prior tax-loss carryforwards, the company does not expect to pay significant cash income taxes in the United States through 2020.

On a GAAP basis, Goodyear’s fourth quarter 2014 net income available to common shareholders was $2.1 billion ($7.68 per share). Excluding certain significant items, most notably the release of the U.S. tax valuation allowance, adjusted net income was $166 million (59 cents per share).

Full-Year Results

Goodyear’s 2015 sales were $16.4 billion, compared to $18.1 billion in 2014. Sales were impacted by $1.6 billion in unfavorable foreign currency translation.

Tire unit volumes totaled 166.2 million, up 3 percent from 2014, due in part to the acquisition of NGY in Japan. Replacement tire shipments were up 2 percent. Original equipment unit volume was up 3 percent.

The company’s segment operating income of $2.0 billion was up 18 percent from last year. Compared to the prior year, the increase reflects favorable price/mix net of raw materials and higher volume, partially offset by cost inflation and unfavorable foreign currency translation.

On a GAAP basis, Goodyear’s 2015 net income available to common shareholders was $307 million ($1.12 per share). Excluding certain significant items, most notably the deconsolidation of the Venezuelan subsidiary, adjusted net income was $906 million ($3.32 per share).

Full-year 2015 adjusted net income was also impacted by $165 million (60 cents per share) of U.S. tax expense following the release of the company’s U.S. tax valuation allowance.

On a GAAP basis, net income available to common shareholders for 2014 was $2.4 billion ($8.78 per share). Excluding certain significant items, most notably the release of the U.S. tax valuation allowance, adjusted net income was $790 million ($2.83 per share).

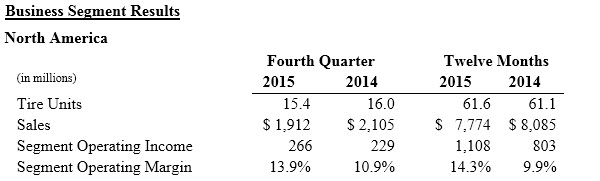

North America’s fourth quarter 2015 sales decreased 9 percent from last year to $1.9 billion. Sales reflect a 4 percent decrease in tire unit volume, primarily due to the sale of the former Goodyear Dunlop Tires North America Ltd. business (GDTNA). Replacement tire volume was down 1 percent. Original equipment unit volume was down 8 percent.

Fourth quarter 2015 segment operating income of $266 million was a 16 percent improvement over the prior year and a fourth quarter record. The improvement was primarily driven by favorable price/mix net of raw materials, as well as cost reduction actions.

The sale of GDTNA negatively impacted North America volumes by approximately 400,000 units (2 percent of the total), sales by $61 million and segment operating income by $10 million.

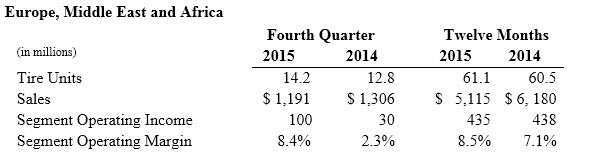

While Europe, Middle East and Africa’s fourth quarter tire unit volumes were up 11 percent, sales decreased 9 percent, primarily due to unfavorable foreign currency translation. Replacement tire shipments were up 12 percent. Original equipment unit volume was up 10 percent.

Fourth quarter 2015 segment operating income of $100 million was $70 million above the prior year primarily due to higher volume, partially offset by unfavorable foreign currency translation.

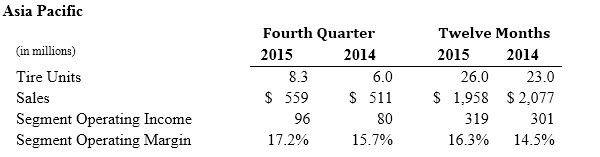

Asia Pacific’s fourth quarter sales increased 9 percent from last year to $559 million. Sales reflect a 38 percent increase in tire unit volume, primarily due to the NGY acquisition. This improvement was partially offset by unfavorable foreign currency translation. Replacement tire shipments were up 57 percent. Original equipment unit volume was up 19 percent.

Fourth quarter segment operating income of $96 million was up 20 percent from last year and a record, driven by higher volume and lower raw material costs.

The acquisition of NGY positively impacted Asia Pacific volumes by approximately 1.6 million units (19 percent of the total) and sales by $68 million. The net favorable impact on segment operating income of the NGY acquisition and the sale of the company’s 25 percent interest in Dunlop Goodyear Tires Ltd. was $1 million.

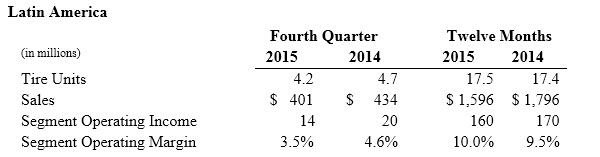

Latin America’s fourth quarter sales decreased 8 percent from last year to $401 million. Sales reflect unfavorable foreign currency translation and an 11 percent decrease in tire unit volume. Replacement tire shipments were down 7 percent. Original equipment unit volume was down 30 percent, primarily in Brazil.

Fourth quarter segment operating income of $14 million was down 30 percent from a year ago primarily due to cost inflation.

Operating income in Venezuela for the 2015 fourth quarter was $22 million, up $2 million from the prior year. Full-year operating income in Venezuela was $119 million, up $59 million from 2014. Full-year 2015 operating income excludes foreign currency exchange losses related to the Venezuelan bolivar fuerte of $34 million.

Venezuelan Deconsolidation

Effective December 31, 2015, the company deconsolidated the financial statements of its subsidiary in Venezuela and began reporting its results using the cost method of accounting. As a result, it recorded a one-time $646 million pre-tax charge ($577 million after-tax) in the fourth quarter of 2015. Goodyear continues to maintain manufacturing and sales operations in the country.

2016 Financial Targets

The company’s 2016 financial targets are:

- Segment Operating Income growth of between 10 percent and 15 percent from ongoing operations (excludes Venezuela),

- Positive Free Cash Flow from Operations and

- An Adjusted Debt to EBITDAP ratio of 2.0x to 2.1x at year-end.

Shareholder Return Program

The company paid a quarterly dividend of 7 cents per share of common stock on December 1, 2015. The Board of Directors has declared a quarterly dividend of 7 cents per share payable March 1, 2016, to shareholders of record on February 1, 2016.

As a part of its previously announced $450 million share repurchase program, the company repurchased 3 million shares of its common stock for $100 million during the fourth quarter.

On February 4, 2016, the company’s Board of Directors authorized a $650 million increase in the share repurchase program, bringing the total to $1.1 billion.

Goodyear’s record performance has resulted in significant stock price appreciation during the three year period ended December 31, 2015. The company’s total shareholder return over this period totaled nearly 175 percent, placing it in the 94th percentile of the S&P 500 and the highest ranked manufacturer in the automotive sector.

Click on the image below to view an infographic summary of Q4 2015 results.